What You Need To Know Ahead of Targa Resources’ Earnings Release

Houston, Texas-based Targa Resources Corp. (TRGP) owns, operates, acquires, and develops a portfolio of complementary domestic midstream infrastructure assets in North America. With a market cap of approximately $38 billion, Targa Resources operates through Gathering and Processing and Logistics and Transportation segments.

The midstream energy giant is set to announce its Q1 results before the market opens on Thursday, May 1. Ahead of the event, analysts expect Targa to report non-GAAP profit of $2.04 per share, up a staggering 67.2% from $1.22 per share reported in the year-ago quarter. While the company has surpassed Wall Street’s earnings projections twice over the past four quarters, it has missed the estimates on two other occasions.

For the full fiscal 2025, its earnings are expected to come in at $8.34 per share, up 43.5% from $5.74 per share reported in fiscal 2024. While in fiscal 2026, its earnings are expected to grow 19.1% year-over-year to $9.93 per share.

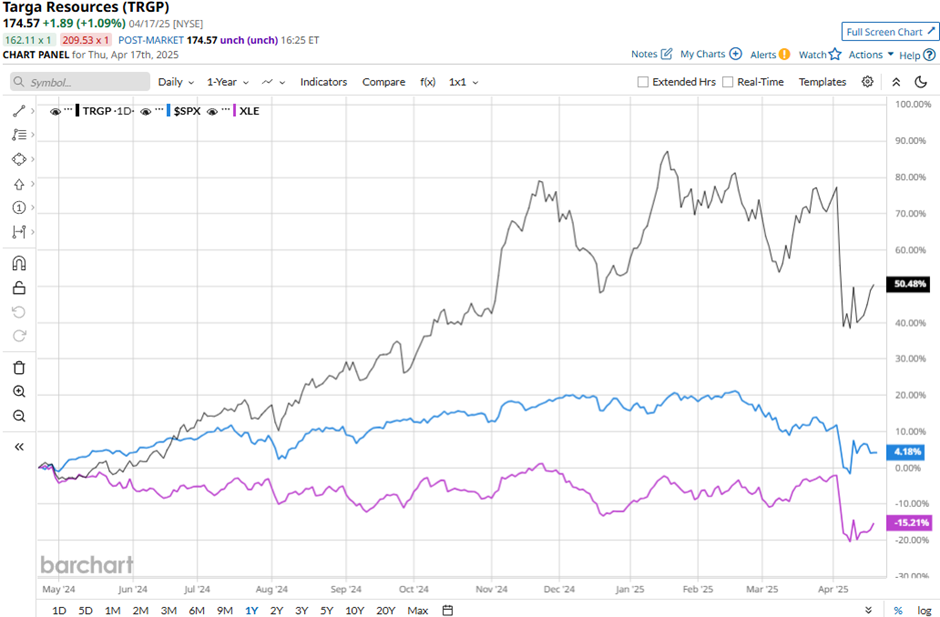

TRGP stock has soared 55.6% over the past 52 weeks, significantly outpacing the Energy Select Sector SPDR Fund’s (XLE) 13.4% drop and the S&P 500 Index’s ($SPX) 5.4% gains during the same time frame.

Targa Resources’ stock prices dropped 2.7% after the release of its mixed Q4 results on Feb. 20. The company observed a notable increase in sales from commodities and fees from midstream services, leading to a 4% year-over-year growth in overall topline to $4.4 billion. This figure surpassed the Street’s expectations by a notable margin. Meanwhile, its adjusted EBITDA increased 17% year-over-year to $1.1 billion. However, its adjusted earnings of $1.44 missed the consensus estimates by 23.4%, making investors jittery.

Nonetheless, analysts remain confident in Targa’s prospects. The consensus view on TRGP is strongly optimistic, with a “Strong Buy” rating overall. Of the 19 analysts covering the stock, 18 recommend “Strong Buy” while one advocates a “Moderate Buy” rating. Its mean price target of $224.65 suggests a 28.7% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.